Moniepoint is a leading fintech company providing digital financial services like payments, loans, and investments in Nigeria. One of their key offerings is Moniepoint POS – an Android point-of-sale terminal for merchants and businesses.

This article provides a detailed guide on how to get a Moniepoint POS terminal, along with charges, commission structure, and application process.

Read Also: How to Get Palmpay POS 2023 [Complete Guide]

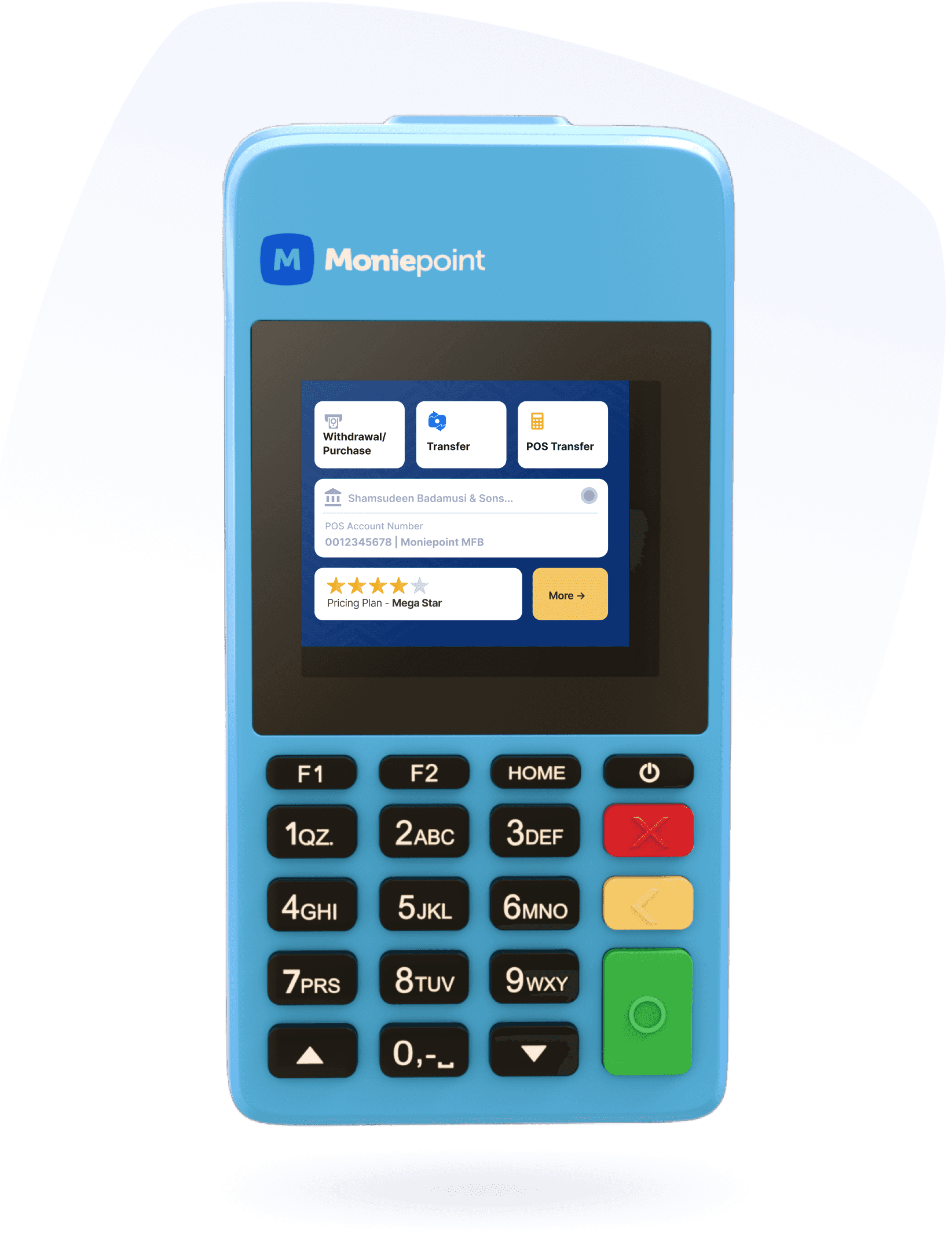

Overview of Moniepoint POS

Moniepoint POS is a smart Android point-of-sale terminal offered by fintech provider Moniepoint.

Key features:

- Accept card payments from customers

- Process cash withdrawals and deposits

- Make fund transfers

- Pay utility bills

- Works offline with USSD

- Inventory management

- Detailed reports and statements

Moniepoint Point-of-Sale platform uses biometric authentication for secure transactions. It allows merchants and businesses to offer cashless payment options to customers and manage transactions digitally.

Benefits of Moniepoint POS

Some of the major benefits of using the Moniepoint Point-of-Sale platform for your business:

- Expand revenue by accepting debit/credit card payments

- Eliminate the risk of handling cash.

- Get detailed sales reports and inventory management

- Cost-effective solution with low charges

- Offline functionality via USSD when there is no internet

- PCI DSS compliant, providing secure transactions

- Deposits are reflected in the bank account within 24 hours

- Dedicated customer support

The POS enables businesses to leverage digital payments for easier financial management and operations.

Moniepoint POS Features and Specifications

Moniepoint Point-Of-Sale device has an intuitive touchscreen Android terminal with the following features:

- 7-inch LCD

- Android operating system

- 4G LTE, WiFi, Bluetooth, and SIM connectivity

- Biometric fingerprint authentication

- Camera for QR code scanning

- Receipt printer

- 16GB Memory + 2GB RAM

The company provides the POS device along with the following:

- Debit card for settlements

- POS stand and accessories

- Complimentary insurance

The terminal supports USSD functionality for offline transactions without internet connectivity.

How to Apply for Moniepoint POS

Here is a step-by-step guide to getting a Moniepoint Point-Of-Sale terminal for your business in Nigeria:

1. Check Eligibility

To qualify for a Moniepoint Point-Of-Sale device, your business must:

- Have an active corporate bank account

- Be registered with the CAC

- Have sizeable daily customer traffic to meet minimum volume requirements

- Operate in an approved location

2. Contact Moniepoint Sales

Reach out to Moniepoint via:

- Email: sales@moniepoint.com

- Phone: 01-700-MONIEPOINT

- Website contact form

Discuss your business operations and location. The sales team will assess your eligibility.

Read Also: Opay User Guide: How to Use Opay and Get a Free POS

3. Submit Required Documents

If eligible, you will need to submit certain documents:

- CAC documents

- Board Resolution

- Business address information

- Bank account details

- Valid ID of account owners

This is required for underwriting and to complete KYC.

4. Sign Merchant Agreement

Once your application is approved, you must sign a legal Merchant Service Agreement with Moniepoint, defining the Point-of-Sale terms and conditions.

5. Deploy POS Terminal

Moniepoint will deliver and install the POS device at your approved business location.

Once all formalities are completed, the terminal will be activated within 2-3 working days.

Charges and Commissions on Moniepoint POS

Moniepoint has a competitive and transparent pricing structure for Point-Of-Sale services:

Transactions

- Card payments – 1.5% (min N100)

- Cash deposit – N100 flat

- Cash withdrawal – N50 + 1%

- Funds transfer – N20 flat

- Utilities payment – N50 flat

Settlement

- Next day settlement into business bank account

Device

- Leased at N23,000 one-time fee (free maintenance)

Support

- Dedicated account manager

- 24×7 customer service

There are no hidden charges. Merchants earn full transaction value minus transparent charges.

Moniepoint POS Daily Target

To retain the POS terminal, merchants must meet a minimum transaction volume target of N20,000 daily. This ensures viability for both the business and Moniepoint.

Failing to meet targets for some days can lead to a reevaluation of POS allocation. So, ensure your operations drive adequate daily card payment volumes.

How to Apply for Moniepoint POS Loan

Moniepoint also offers business loans to existing Point-Of-Sale merchants based on their transaction history.

Key features of Moniepoint POS loan:

- Minimum 6 months with Moniepoint POS

- Quick processing within 48 hours

- Competitive interest rates from 1.33% monthly

- Flexible repayment of up to 12 months

To apply, visit https://atm.moniepoint.com/

Read Also: How to Get Paga POS Machine (Price and Charges)

To Sum Up

Moniepoint provides an advanced Point-Of-Sale solution to help Nigerian businesses offer card payment options and manage transactions digitally.

The application process is smooth for eligible businesses. Charges are competitive and there are no hidden fees.

Leveraging Moniepoint POS terminals can significantly improve sales, operations, and financial management for retail businesses. The loan offering also provides funding to existing merchants.

Adopting their POS solution is an easy for Nigerian businesses to embark on their cashless journey.

RELATED POST

Top 10 Best Banks for Students in Nigeria

Stanbic Bank Kenya USSD Code – How to Use *990# for Quick Transactions

UBA USSD Code – How to Activate, Check Balance, Transfer Money and Buy Airtime

10 Best Recipe and Cooking Apps for iPhone and Android

Polaris Bank New USSD Code – How to Activate, Transfer and Check Balance